In an era where fraudulent insurance claims are on the rise, leveraging technology to mitigate these risks has become paramount for insurance companies. Video surveillance stands out as a powerful tool in this battle, offering a tangible way to validate claims and ensure their legitimacy. This comprehensive guide delves into how video surveillance is revolutionizing the insurance industry by reducing fraudulent claims, thereby saving companies millions and maintaining integrity within the sector.

The Rise of Fraudulent Insurance Claims

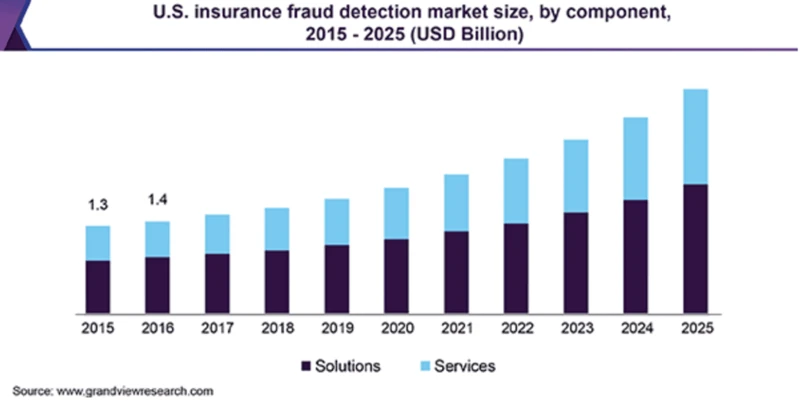

Fraudulent insurance claims are a growing concern, costing the industry billions annually. These false claims range from exaggerated damages in auto accidents to completely staged events. The implications are far-reaching, affecting not only the financial health of insurance companies but also leading to higher premiums for honest policyholders. It’s a challenge that necessitates innovative solutions.

Understanding Video Surveillance

Video surveillance involves the use of video cameras to monitor an area, providing recorded evidence of activities. This technology has evolved significantly over the years, with modern systems featuring high-definition recording, remote monitoring capabilities, and advanced analytics. It’s a tool that’s become indispensable in various sectors, including retail, banking, and now, insurance.

How Video Surveillance Deters Fraud

The presence of video surveillance can act as a significant deterrent to fraudulent activities. Knowing that an area is under surveillance discourages individuals from attempting deceitful acts, as the risk of being recorded and caught is high. It’s a proactive approach to fraud prevention that can save insurance companies considerable resources in the long run.

Video Verification of Claims

One of the key benefits of video surveillance in the insurance sector is the ability to verify claims through visual evidence. Insurers can review footage to confirm the circumstances surrounding a claim, ensuring that it aligns with the account provided by the policyholder. This level of validation is invaluable in identifying and rejecting fraudulent claims.

Case Studies: Success Stories in Insurance

Several insurance companies have successfully integrated video surveillance into their fraud prevention strategies. For instance, a notable case involved a major insurer using surveillance footage to disprove a claim of theft, saving thousands in potential payouts. These success stories highlight the effectiveness of video technology in protecting against fraudulent activities.

Integration with Other Technologies

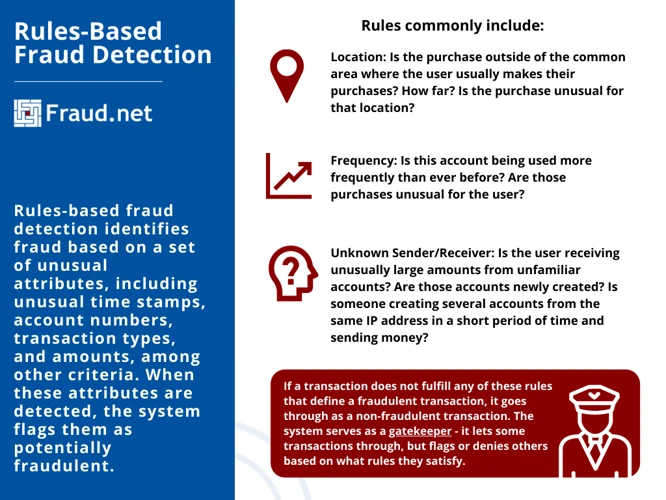

Video surveillance often works hand in hand with other technologies for enhanced fraud detection. For example, artificial intelligence (AI) can analyze video footage in real-time, flagging unusual activities that may indicate fraudulent behavior. Similarly, data analytics can uncover patterns or anomalies in claims that warrant further investigation, guiding insurers on where to direct their surveillance efforts.

Legal and Ethical Considerations

While video surveillance is a powerful tool, it’s essential to navigate the legal and ethical implications carefully. Privacy laws vary by region, and insurers must ensure that their surveillance practices are compliant. Additionally, maintaining transparency with policyholders about the use of video surveillance can help mitigate privacy concerns and build trust.

Challenges in Implementing Video Surveillance

Despite its benefits, integrating video surveillance into insurance operations is not without challenges. These include the initial costs of setting up a surveillance system, the need for ongoing maintenance, and the potential for technological issues. Moreover, analyzing vast amounts of video data requires significant resources and expertise.

Training and Development for Fraud Detection

To maximize the effectiveness of video surveillance in detecting fraud, insurance companies must invest in training and development. This includes educating staff on analyzing video footage and integrating insights from surveillance into the claims process. Additionally, staying abreast of advancements in surveillance technology ensures that insurers can leverage the latest tools in their fraud prevention efforts.

The Role of Policyholders in Fraud Prevention

Policyholders play a crucial role in preventing insurance fraud. By consenting to the use of video surveillance and cooperating with insurance companies, they contribute to a transparent and fair claims process. Educating policyholders about the implications of fraud and how surveillance can protect their interests is vital in fostering a collaborative approach to fraud prevention.

Future Trends in Surveillance and Fraud Prevention

The future of surveillance in insurance looks promising, with emerging technologies poised to enhance fraud detection capabilities further. Innovations such as drone surveillance for assessing property damage and wearable cameras for real-time accident documentation are on the horizon. These advancements promise to provide even more robust evidence for validating claims and combating fraud.

Global Perspectives on Surveillance and Insurance Fraud

The use of video surveillance in reducing insurance fraud is a global phenomenon, with practices varying across different regions. Some countries are pioneers in adopting surveillance technology for insurance purposes, while others are more conservative due to stringent privacy laws. Exploring these global perspectives offers valuable insights into best practices and the evolving landscape of insurance fraud prevention.

Building a Culture of Integrity

Ultimately, the goal of incorporating video surveillance into insurance operations is to foster a culture of integrity. By demonstrating a commitment to fairness and transparency, insurance companies can discourage fraudulent behavior, encourage honest reporting from policyholders, and maintain trust. It’s about creating an environment where fraud is not only challenging to commit but also undesirable from a moral standpoint.

In the modern world, video surveillance plays a crucial role in enhancing security and safety across various domains. Whether you’re looking to safeguard your business, ensure the integrity of insurance claims, or enhance the security of residential areas, understanding the impact of video surveillance is key. Explore our comprehensive articles on the role of video surveillance in preventing theft and robbery in businesses, the role of video surveillance in insurance claims, and the benefits and drawbacks of video surveillance in residential areas for a deeper insight. Additionally, for those considering a hands-on approach, our articles on the benefits of DIY installation of video surveillance and video surveillance insurance benefits provide valuable information on how these systems can serve as a deterrent against fraudulent activities and contribute to a safer environment.

Conclusion

Video surveillance represents a formidable tool in the fight against fraudulent insurance claims. By offering a means to verify claims with tangible evidence, it plays a critical role in safeguarding the interests of both insurers and honest policyholders. However, its success hinges on careful implementation, adherence to legal and ethical standards, and ongoing collaboration with all stakeholders. As technology continues to evolve, so too will the capabilities of video surveillance in ensuring the integrity of the insurance claims process.